Abu Dhabi boasts first-class infrastructure and unparalleled global connectivity, making it a premier international destination. Its exceptional qualities make it an ideal location to live, work, and conduct business.

A financial centre that provides transparency, efficiency, and integrity, through its progressive frameworks, future focused infrastructure, all within a familiar independent legal jurisdiction – ADGM is the perfect platform for success.

Our community of business professionals, entrepreneurs, and investors can depend on ADGM to provide timely news and reliable insights.

At ADGM, we offer various support options, including contact details, FAQs, enquiry forms, and a whistleblowing form.

News

Abu Dhabi Ranks as the Top FinTech Hub for MENA Region

ADGM FSRA: 17 Apr 2017

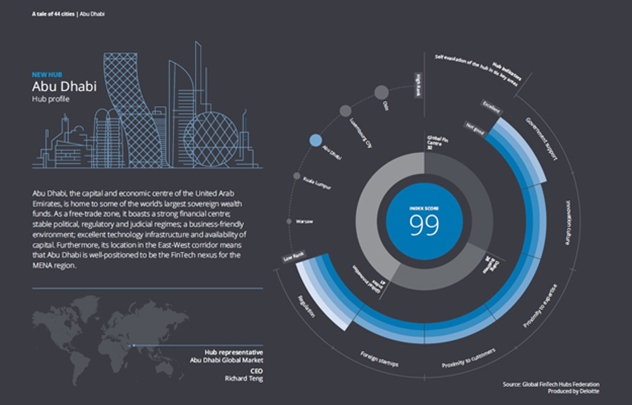

Abu Dhabi, with Abu Dhabi Global Market (ADGM) representing its Fintech Hub in advancing Fintech developments, has been ranked as the top FinTech Hub for the MENA region in the latest Global FinTech Hubs Review, “A Tale of 44 Cities”, by Deloitte in partnership with the Global FinTech Hubs Federation (the Federation). This special FinTech Hubs review was released at the 2017 Innovate Finance Global Summit (IFGS 2017) held in London on April 10th 2017 to an audience of 2,500 international Fintech participants. Mr Richard Teng, CEO of FSRA of ADGM, the international financial centre in Abu Dhabi, also spoke at the Global Fintech Hubs Panel of IFGS 2017 with panel members from the UK, the US, Singapore and India discussing Fintech developments and collaboration.

The FinTech Hubs report provides insights of FinTech activities across 44 FinTech Hubs, assessing each hub on six categories including the ease of launching a Fintech business in the hub, the competitiveness of the financial centre and the extent of innovation in the economy.

From the 44 cities, Abu Dhabi is ranked top FinTech hub in the MENA region. The Deloitte report reiterated that the launch of ADGM’s Regulatory Laboratory (RegLab) for FinTech startups, the only “live” Fintech regulatory regime in the MENA region with 11 Fintech players in its first batch of applications, as a “milestone success for Abu Dhabi and marked the openness and support by regulators and government towards innovation.” The report further highlighted that the collaboration between banks and startups, and the banks’ innovation strategies have added to Abu Dhabi’s “success story as it highlights the attitude of the main institutions towards FinTech”.

The report has pointed out that Abu Dhabi, being located in the East-West corridor, is well-positioned to be the FinTech nexus for the MENA region. Abu Dhabi is citied as the economic centre of the United Arab Emirates and provides a strong financial centre; political stability; internationally aligned regulatory and judicial regimes; a business-friendly environment; excellent technology infrastructure and availability of capital.

Mr Richard Teng, Chief Executive Officer, Financial Services Regulatory Authority of ADGM said, “We are pleased that Abu Dhabi & ADGM have been recognised as the top FinTech Hub in the MENA region. This recognition is a strong endorsement of the initiatives and efforts that we have introduced to develop both the regulatory framework and ecosystem needed to support the ambition of Fintech stakeholders. ADGM has created many first in the MENA region including the first to formulate a regulatory regime to licence FinTech participants, the first to develop a Regulatory Laboratory that provides a safe and controlled environment to foster Fintech innovation, and the first jurisdiction to establish a FinTech Bridge with Singapore that offers Fintech stakeholders greater access to markets, capital and regulatory recognition. The strategic support of our government, MOU partners and the community has been instrumental to the advancement of the Fintech growth and activities in Abu Dhabi and the UAE. As an international financial centre, ADGM will continuously enhance its business environment and FinTech ecosystem to better serve the needs of the MENA region now, and well into the future. We will continue to collaborate with Fintech stakeholders and local and international industry providers to identify areas of innovation and business opportunities.”