Abu Dhabi boasts first-class infrastructure and unparalleled global connectivity, making it a premier international destination. Its exceptional qualities make it an ideal location to live, work, and conduct business.

A financial centre that provides transparency, efficiency, and integrity, through its progressive frameworks, future focused infrastructure, all within a familiar independent legal jurisdiction – ADGM is the perfect platform for success.

Our community of business professionals, entrepreneurs, and investors can depend on ADGM to provide timely news and reliable insights.

At ADGM, we offer various support options, including contact details, FAQs, enquiry forms, and a whistleblowing form.

News

ADGM Launches its Fintech Reglab

ADGM FSRA: 02 Nov 2016

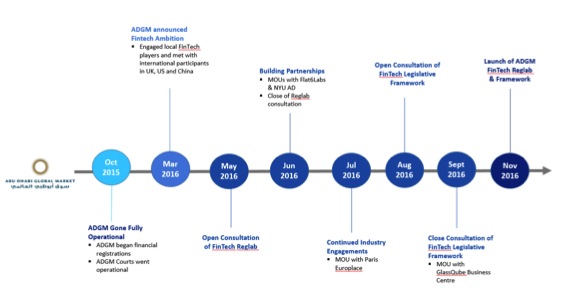

Abu Dhabi Global Market (ADGM), the International Financial Centre in Abu Dhabi, is pleased to launch its Regulatory Laboratory (RegLab) with the implementation of its FinTech legislative framework with effect from 2 November 2016. This follows ADGM’s announcement in March 2016 to develop Abu Dhabi as the FinTech hub in the MENA region, and after an extensive consultation and engagement with local and global FinTech industry stakeholders.

ADGM’s Reglab is a tailored regulatory regime for FinTech participants. It is designed to foster innovation within the UAE financial services market for both new market entrants and existing financial institutions. By taking into account the unique business model and risks of the Fintech participant and customising the test boundaries and regulatory requirements accordingly, the RegLab allows the participant to develop and test its FinTech proposition in a safe environment while not putting undue regulatory burden on the participant. As the first of such initiative in the region, ADGM’s RegLab authorises FinTech participants for a period of up to two years to develop and test their FinTech proposition.

Application to ADGM Reglab Commences Immediately

With effect from 2 November 2016, ADGM will open its doors to applications from local and international FinTech participants and businesses to participate in the ADGM RegLab. Applications for the first RegLab cohort will close on 31 January 2017. More details of the RegLab regime and application process can be found here.

The FinTech Regulatory Laboratory Guidance is available here.

Mr Richard Teng, Chief Executive Officer, FSRA of ADGM said, “We are very excited to launch the ADGM RegLab and it is encouraging that interests have been pouring in since we announced our plans. ADGM’s commitment to and pursuit of innovation have always been part of its DNA and culture as an International Financial Centre serving the business and financial aspirations of Abu Dhabi and the MENA region.

In these last 8 months, we met with numerous FinTech stakeholders, local and global industry players, and global FinTech hubs to raise the profile of the FinTech community in Abu Dhabi. We have developed a progressive regulatory environment to allow the establishment and growth of FinTech players at ADGM and to anchor their innovations in Abu Dhabi and regionally. We welcome FinTech applicants from the MENA region and beyond to take advantage of this platform to develop and fulfil their aspirations. Firms and stakeholders can continue to rely on ADGM to help them navigate through the challenging environment of today and tomorrow and accelerate their business growth in this region.”

Joint Collaborations & Industry Engagements

The FSRA continues to build up its efforts in collaborating with industry stakeholders including accelerators, co-working business centres, academic, financial and technological institutions, regulatory agencies, industry associations and the start-up community to develop the wider FinTech ecosystem.

A new ADGM FinTech web portal will be launched soon to provide regulatory updates and information that the FinTech community will find useful.