Abu Dhabi boasts first-class infrastructure and unparalleled global connectivity, making it a premier international destination. Its exceptional qualities make it an ideal location to live, work, and conduct business.

A financial centre that provides transparency, efficiency, and integrity, through its progressive frameworks, future focused infrastructure, all within a familiar independent legal jurisdiction – ADGM is the perfect platform for success.

AccessRP is a next-generation digital platform transforming the real estate experience in ADGM. Designed to streamline interactions across the ecosystem, AccessRP brings together landlords, developers, and tenants in one seamless environment, providing real-time access to services, data, and insights.

Our community of business professionals, entrepreneurs, and investors can depend on ADGM to provide timely news and reliable insights.

At ADGM, we offer various support options, including contact details, FAQs, enquiry forms, and a whistleblowing form.

Highlight & stories

07 December 2023, by Oliver Berger, Head of Middle East and North Africa, State Street

The investment industry has largely benefitted from the rapid growth of information technologies in this century, especially in the sphere of data.

Advancements in online communications, computer processing power and process automation capabilities have created new opportunities for investment institutions looking at operational excellence, improved decision making and quicker time-to-market. Now, ‘big data’ is playing a crucial role in growth strategies for investment organisations across the globe.

Recently, artificial intelligence (AI) has enabled machines to assimilate and understand vast quantities of data from disparate sources, to provide comparisons and draw conclusions in a matter of minutes that would have otherwise taken longer time for legacy systems and data analysts.

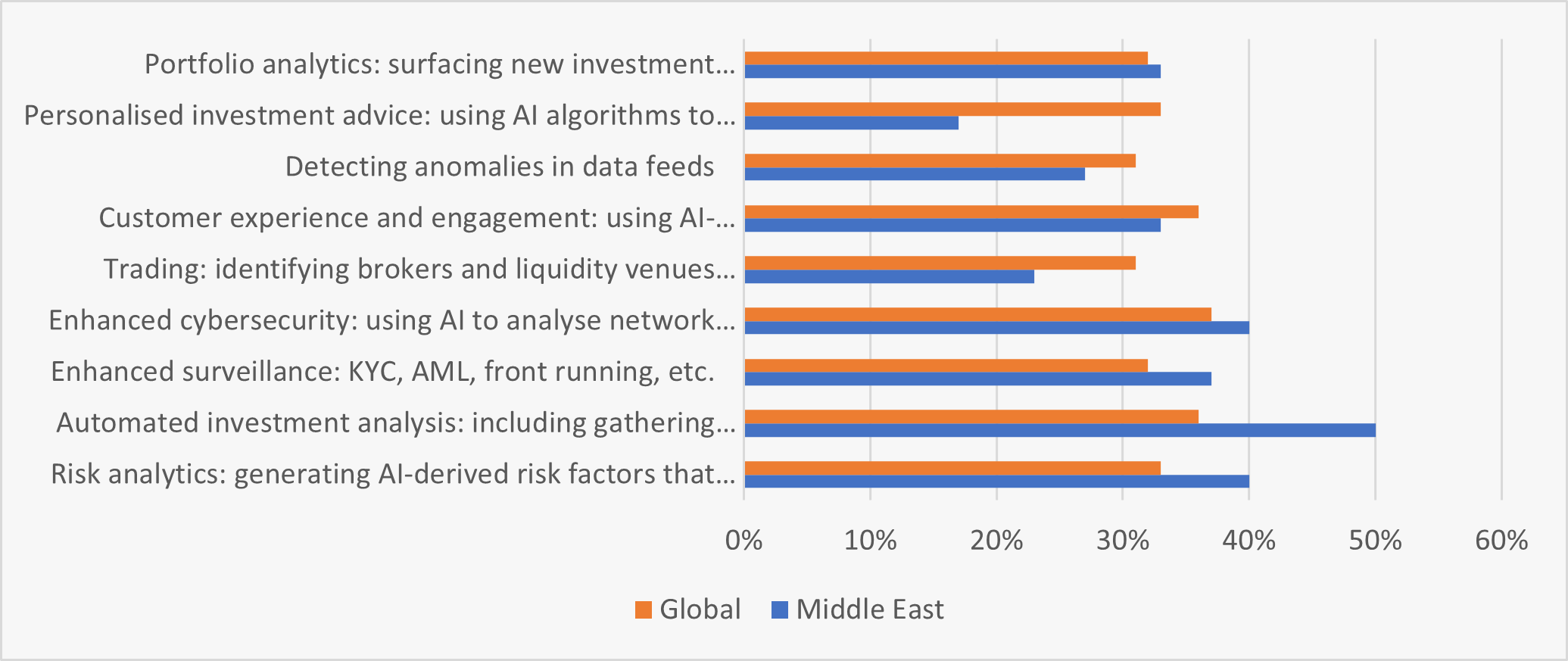

Investment institutions are positioning themselves to leverage the advantage of these developments in data operations to build relationships with clients, members and third party partners. According to the recent State Street Data Opportunities Study, the Middle East is well positioned to harness the power of generative AI. Respondents from the region were more likely than their global counterparts to see AI promoting value across a number of operational areas, including automation of investment analysis, cybersecurity and Know Your Customer/Anti Money Laundering (KYC/AML) measures.

Fig. 1. Operational areas with high potential for improvement with AI

In general, Middle Eastern respondents were more inclined to see investment in technology as the core of their future data strategies. More than half (57 percent) said it was their area of “most focus”, compared to 52 percent of their global counterparts.

These responses are backed by their plans for investing in new technology systems. A little over a quarter (26 percent) were planning to upgrade more than 50 percent of their existing technology, with a view to their future data plans (a further 70 percent were planning to upgrade between 10 percent and 50 percent). In this regard, their existing systems were ahead of their global peers, of whom 41 percent were planning to replace more than half of their technology stacks.

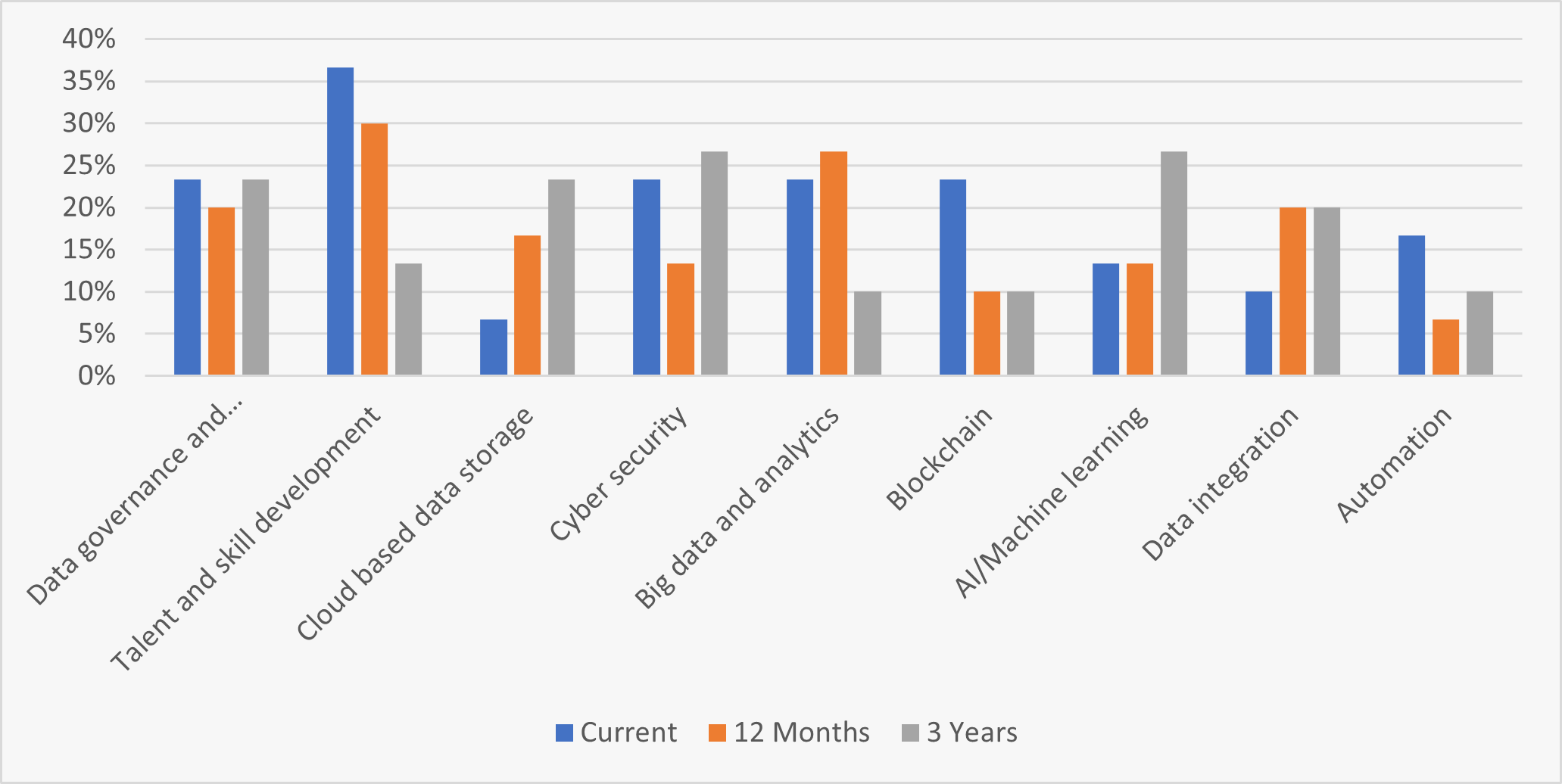

The results of our survey also told a story of changing data and technology priorities over time. At a more granular level, specific types of technology or areas of operations that require investing in, varied depending on the timescale of the investment, with many of the more pure technology focused areas gaining importance further into the future.

While AI is not an immediate investment priority, it has gained significant attention over a three year horizon, where organisations view it as an area of highest technology investment along with cybersecurity. This is also true of cloud storage and data integration, while the opposite held true for investing in workforce technology skills and training, which is the current top investment.

Automation is an exception to this as it is more important to institutions today than they expected it to be in future. Interestingly, blockchain, which was jointly the second highest investment area in the region, is expected to attract the joint lowest level of investment on a three year view and has dropped to second lowest in 12 months’ time.

Fig. 2. Technology investment priority areas over time

This is surprising not only because the results show blockchain to be an immediate priority, but because the use cases for it (including atomic settlement, tokenisation and fractionalisation of illiquid asset classes, custody based on cryptographic security) have significant potential for allowing asset managers and owners to speed and streamline their processes, offering a wider range of lower cost investments to a larger base of customers.

However, the sudden growth of generative AI has made it the pressing emerging technology story of the moment. Therefore, the allocations to exploring use cases for blockchain and other distributed ledger technology (e.g., atomic settlement, asset tokenisation and fractionalisation, custody based on cryptographic security) are being diverted over the short term to the implications of machine learning.

AI technologies such as large language models (LLM) and natural language processing (NLP) have much to offer, but identifying the right use cases is crucial. Applications of these advances already in use include solutions that ensure insights secured from data are accurate, complete and reliable. For example, machine learning can be used to flag anomalies in data as part of a broader data verification program. Sentiment analysis is another area of significant interest along with using AI tools to increase productivity.

The story of how these nascent technologies will interact in the future with investment institutions’ longstanding goal of optimizing their data is a fascinating one that will develop as the technologies improve and the institutions understand them better. The Middle East has already proven itself to be an important growth centre for financial services in recent decades, and they are well positioned to leverage the next generations of data technology that will be crucial to gain alpha in the future.

The progressive regulations in Abu Dhabi Global Market (ADGM), the international financial centre of the Capital of the UAE, have attracted tech companies from all over the globe that foster innovation such as AI, big data, and blockchain activities. The presence of such companies in Abu Dhabi will digitalize services provided by financial institutions and enhance their capabilities by automating processes, reduce operation costs, generating alpha and improve data quality resulting with an enhanced customer experience. ADGM has provided the infrastructure that has allowed the tech ecosystem to grow and thrive.