Abu Dhabi boasts first-class infrastructure and unparalleled global connectivity, making it a premier international destination. Its exceptional qualities make it an ideal location to live, work, and conduct business.

A financial centre that provides transparency, efficiency, and integrity, through its progressive frameworks, future focused infrastructure, all within a familiar independent legal jurisdiction – ADGM is the perfect platform for success.

AccessRP is a next-generation digital platform transforming the real estate experience in ADGM. Designed to streamline interactions across the ecosystem, AccessRP brings together landlords, developers, and tenants in one seamless environment, providing real-time access to services, data, and insights.

Our community of business professionals, entrepreneurs, and investors can depend on ADGM to provide timely news and reliable insights.

At ADGM, we offer various support options, including contact details, FAQs, enquiry forms, and a whistleblowing form.

Highlight & stories

05 December 2021, by ADGM's Staff Editor

Abu Dhabi Global Market guides the virtual asset industry with the world’s first fully comprehensive regulatory framework, ushering in a period of dramatic economic growth and unlocking endless opportunities for innovation.

Traditional finance and the virtual asset economy have become increasingly intertwined this year. From the development of crypto-first ecommerce to the proliferation of non-fungible tokens (NFTs), it was a year of unrestrained tech adoption, innovation, integration and – in some circumstances -even resistance.

By some definitions, a virtual asset may well take the form of any digitised token of value that could be traded, transferred or used for payment. A potential advantage of developing a virtual asset economy may be its ability to transfer value swiftly, securely, and efficiently, and ultimately democratise access to innovative financial services for businesses and people.

Embracing a virtual asset economy, that runs in tandem with, and spurs the development of, traditional financial markets, holds new possibilities enabled by the tokenisation of traditional financial instruments, commodities and physical assets in the MENA region. Whether through virtual assets or businesses adopting new distributed operating models running on distributed ledger technologies, blockchain is transforming the global financial and capital markets.

The promise of virtual assets is that they provide an accessible, fast, and cost-effective alternative to traditional means of physical and electronic value transfer - making access to financial products more feasible for those who may have historically missed opportunities to benefit from products and services offered by traditional financial services firms.

Virtual asset transactions on public blockchains are pseudonymous and in some cases completely anonymous due to the nature of the blockchains that support the virtual assets. As the popularity of virtual assets continues to surge, the additional scrutiny by regulators around the world has increasingly been focussed on the risks related to crime, money laundering and terrorist financing activities being conducted using the virtual assets.

One thing to note is that blockchain technology is not entirely new, it has been around for over 10 years now. Since their creation, virtual assets like bitcoin have become hugely popular as trading and investment instruments. Nonetheless, without a robust regulatory framework and ongoing oversight, the virtual asset industry will remain an outlier in its significance compared to the overall finance industry.

Jurisdictions must adopt a balanced and technology neutral approach to ensure a healthy and orderly virtual asset industry continues to develop to ensure it delivers on its promises.

Innovation in the virtual assets industry is inevitable and regulators like Abu Dhabi Global Market’s (ADGM) Financial Services Regulatory Authority (FSRA) anticipated that wave by setting in place the world’s first comprehensive regulatory framework in 2018, which acts as a springboard for what is set to be the next evolution in finance.

Abu Dhabi Global Market leads the way

Before the publication of ADGM FSRA’s regulatory framework, virtual assets and virtual asset exchanges/custodians and other intermediaries were subject to limited to no regulatory oversight. The ‘honour system’ was applied until that point, with the players within the virtual asset industry complying, if they wanted to, with industry standards. This did not provide the security and stability to lay the foundations for the long-term growth and development of the virtual asset industry for investors, providers, and end-users.

Therefore, ADGM, being a forward-looking and dynamic jurisdiction, created the world’s first regulatory framework that met the expectations of virtual asset industry players, consumers and traditional financial institutions providing the protection for key stakeholders involved in the virtual asset ecosystem.

ADGM has become the destination of choice for many start-ups, investors, and businesses looking to set foot in the virtual asset market. Since the framework officially came into practice in 2018, ADGM has issued a number of Financial Services Permissions (FSPs) to virtual asset multilateral trading facilities (MTFs),custodians and other intermediaries.

“We believe our robust approach to the regulation of digital and virtual assets is a key pillar of ADGM’s strategy to foster sustainable and responsible innovation in the financial sector. Businesses and consumers holding and investing in digital assets can be assured that our licensed firms are required to comply with the highest standards,” commented Emmanuel Givanakis, CEO of the ADGM Financial Services Regulatory Authority

The ADGM FSRA continuously engages with virtual asset players to

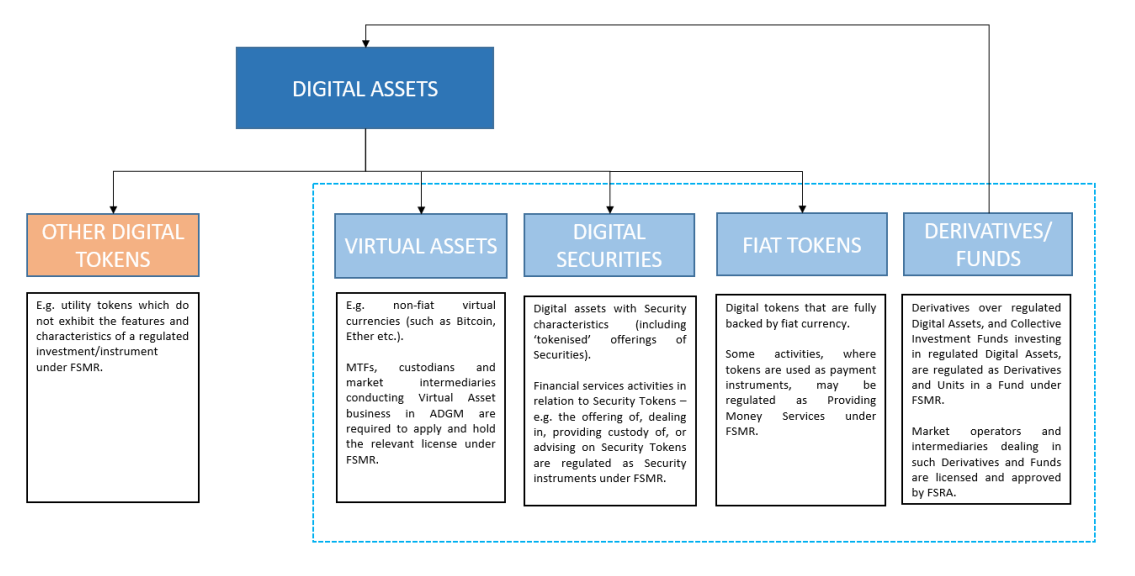

The FSRA set clear guidelines to determine which digital assets are allowed to operate under ADGM’s umbrella, and exactly what is a Virtual Asset: elements in dotted blue square are allowed to operate (Source: Abu Dhabi Global Market’s Virtual Assets Activities Guidance)

Being the first jurisdiction globally to develop and implement a comprehensive virtual asset regulatory framework means that the team at ADGM FSRA has deep insights and practical experience and expertise in handling the unique and complex regulatory landscape that comes with virtual-asset activities. With that in mind, the FSRA engages globally, both bilaterally and multilaterally, to support the efforts of regulatory and industry forums (across IOSCO, FATF and Global Digital Finance, for example) to share insights and to establish partnerships with relevant stakeholders.

It is important to note that as set out in the diagram above, the ADGM Digital Asset framework separately caters for both Virtual Assets and Digital Securities (which has a dedicated framework as laid out here).

Trust and agility at the core of the virtual asset regulatory framework

Knowing the virtual asset industry is in a constant state of development and growth, the FSRA has focused on creating a trustworthy, transparent and fair environment for all stakeholders.

This framework allows the regulator to ensure compliance not only with the regulations and rules of the FSRA but also relevant and applicable UAE laws and international standards which include prevention of money laundering and terrorist financing activities.

With the UAE federal level Anti Money Laundering and Countering the Financing of Terrorism legislation and Financial Action Task Force recommendations on a global level all being applicable to FSRA licensed firms including additional controls mandated by the FSRA for virtual assets, the comprehensive licencing regime is intended to give investors and consumers peace of mind knowing that their virtual assets are stored and transacted safely and securely.