Abu Dhabi boasts first-class infrastructure and unparalleled global connectivity, making it a premier international destination. Its exceptional qualities make it an ideal location to live, work, and conduct business.

A financial centre that provides transparency, efficiency, and integrity, through its progressive frameworks, future focused infrastructure, all within a familiar independent legal jurisdiction – ADGM is the perfect platform for success.

AccessRP is a next-generation digital platform transforming the real estate experience in ADGM. Designed to streamline interactions across the ecosystem, AccessRP brings together landlords, developers, and tenants in one seamless environment, providing real-time access to services, data, and insights.

Our community of business professionals, entrepreneurs, and investors can depend on ADGM to provide timely news and reliable insights.

At ADGM, we offer various support options, including contact details, FAQs, enquiry forms, and a whistleblowing form.

Highlight & stories

06 December 2023, by Peter Lejre, CEO & Co-Founder of MEASA Partners and Senior Advisor to Al Maskari Holding

- The MEASA region (Middle East, Africa, Southern Asia) continues to experience strong growth which will provide attractive investment opportunities.

- Rapid economic development will be associated with consumption and production growth which will need to be met differently to the historic ‘Western approach’.

- Lack of long-term international institutional capital hinders progress towards a sustainable transition.

- Partnerships between private and public capital around scalable and sustainable investment products are needed.

- Abu Dhabi Global Market (ADGM) can become the preferred financial centre for such investment products.

The nomenclature “Middle East, Africa, and Southern Asia (MEASA)” is relatively new, yet it defines a region of long-standing significance. Spanning across 88 countries, from Indonesia in the East to Senegal in the West, and from Turkey in the North to South Africa in the South, the MEASA region is vast and diverse. Each sub-region has its own distinct economic fundamentals and valuable resources: the Middle East boasts vast oil and gas reserves, along with substantial capital held by sovereign wealth funds (SWFs); Africa is rich in mineral resources and arable land; and Southern Asia has emerged as a hub of human capital, fostering a robust ecosystem for technological advancements. Millennia-old patterns of migration, trade, and political alignments have created cultural and economic ties throughout the region. Today, many of these relationships are being further strengthened as bilateral economic activity and political cooperation increase. Countries like the United Arab Emirates and Singapore are playing pivotal roles in encouraging collaboration and serving as financial and logistical gateways into the region.

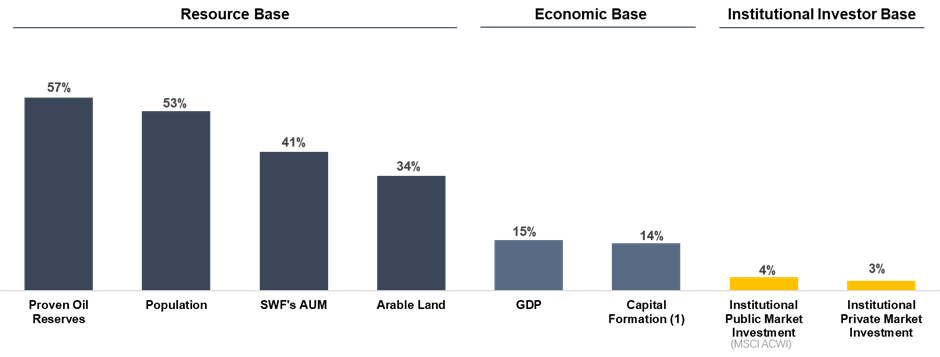

Combined, the region’s resources are vast, even on a global scale. It is home to more than 4 billion people, accounting for 53% of the world’s population, with a median age under 24 years. The region boasts approximately 1 trillion barrels of proven oil reserves, which is 57% of the global proven reserves, 5.4 million km2 of arable land, making up 34% of the global total, and 36 SWFs with a combined assets under management (AUM) of US$ 4.5 trillion, representing 41% of global SWFs’ assets under management (AUM). However, from an economic and investment allocation perspective, the region’s significance is more modest, representing only about 15% to the global GDP, 14% of investments in capital formation, and attracting only 3-4% allocation from large institutional investors. According to recent projections by Our World in Data, the MEASA region will account for almost all of the global population growth until end of the century and around a quarter of the global GDP growth over the coming decades. Notably, as illustrated by data compiled from the World Bank, the region’s real GDP has surged by more than 50% in the last decade.

MEASA’s Global Footprint

Total World equals 100%

Source: Bloomberg, IMF, World Bank, Statistical Review of World Energy, World Population Review, Statista

We anticipate a shift in this balance as the region undergoes rapid economic growth. On the one hand, the global investment community should want to participate in higher growth opportunities to seize higher potential financial returns – especially when compared to slower-growing, mature markets. On the other hand, the global investors need to participate in order to support a sustainable growth trajectory of the region to mitigate possible negative spillovers with potential global impact.

The rapid growth is fuelling enormous increase in consumption necessitating sustainable solutions to avoid adverse effects on income inequality and climate change. A new socio-economic paradigm overcoming the old-fashioned, conventional Western approach is needed, as the consequences could reverberate both regionally and internationally, threatening global stability. Forecast of electricity demand and food consumption underscore the magnitude of the challenge. As indicated by the European Commission Joint Research Center, Africa’s projected electricity demand – the region with the least developed energy infrastructure – is set to grow from 635 Terawatt hours (TWh) per year in 2017 to more than 5,000 TWh by 2070. Given that approximately 80% of the current electricity generation relies on fossil fuels, there is an urgent need to champion more climate-friendly energy sources. In addition, the United Nations projects food demand to almost double by 2050, rising from a yearly intake of 2.9 quadrillion calories in 2012 to more than 5 quadrillion by 2050.

At a time when the world is already far behind meeting the annual investments needed to achieve the Sustainable Development Goals, setting strategic priorities will be increasingly important (current UNCTAD estimate suggests the global annual financing gap to meet the SDGs has ballooned to US$4.3 trillion, double the per-COVID 19 value).

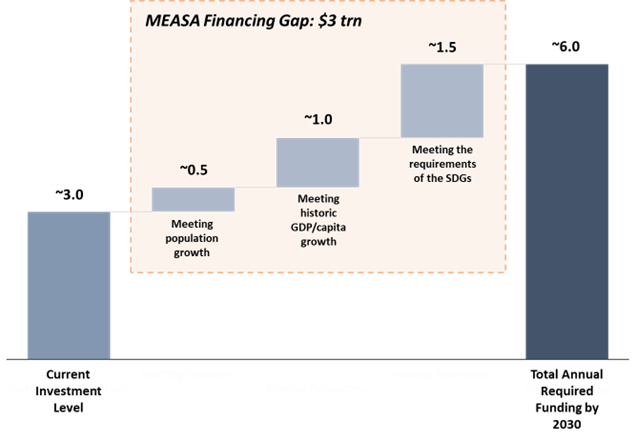

This development is especially pertinent to the MEASA region, as it represents 83% of the countries in the bottom half of the SDG country ratings, including all the ten worst performing countries. Estimating the additional annually required investment level in the MEASA region, looking at three scenarios (i. increasing investments just to meet the population growth, ii. increasing investments to meet population and recent GDP/capita growth, and iii. increasing investments to meet population, recent GDP/capita growth while meeting the SDG requirements), suggest the investment gap specific to the MEASA region is approximately US$3 trillion annually – a doubling of total current investment level.

MEASA SDG Financing Gap

USD trillion estimates, based on Capital Formation

Source: Understanding the Cost of Achieving the SDGs, World Bank, MEASA Partners, Transition Investment Lab

Research by the Transition Investment Lab (TIL), a first of its kind research initiative co-founded by New York University Abu Dhabi (NYUAD), Mubadala Investment Company, and MEASA Partners, suggests that large institutional investors are poised to play a pivotal role.

Professor Bernardo Bortolotti, Executive Director of TIL said: “The total financing gap to meet the SDGs is daunting but in comparison with the US$125 trillion assets managed by the institutional investment community alone, the gap looks less intimidating. The issue is thus not the lack of capital, but how to prioritize investment where it is mostly needed. At TIL, we believe that the MEASA region is uniquely important given the combination of high growth, low SDG country scores, and international institutional capital underweight. Accordingly, the sustainable impact that long-term institutional investors can achieve here far exceeds what they will be able to achieve elsewhere. Moreover, the stringent governance and transparency standards set by such investors can enhance the quality of investment opportunities in the region, further bolstering private capital mobilization.”

So, in this context, what is deterring institutional investors from allocating capital to the region? From discussions with several international institutional investors, we have found that while there is interest in participating, there are several constraints that must be addressed:

- Limited regional understanding: The MEASA region, being newly defined and underrepresented in global indices, is unfamiliar to many institutional investors. To bridge this gap, local stakeholders, especially SWFs, academia, and financial centres such as ADGM, should spearhead initiatives to increase knowledge of the region, through investment forums publications, research papers, etc. In Abu Dhabi initiatives such as the Abu Dhabi Finance Week, the Transition Investment Lab, and in particular the hosting of COP28 are important activities to educate international investors about the region’s investment landscape.

- Rule of law concerns: Despite the region’s alignment with other emerging and frontier markets in terms of investment risk, concerns about rule of law and political stability are heightened in the region. Accordingly, investors will need to prioritize countries for investment based on an evaluation of the regulatory framework. The ADGM, with a regulatory framework based on English Common law and strong regulatory oversight, should therefore be an important access point for the region.

- Reputational risks: Financial scandals, counterparty risks and human rights issues in the region have raised reputational concerns for international investors. Prioritizing well due diligence sustainable investment opportunities, in partnership with local reputable institutional investors, at least partly mitigates such risks.

- Scarcity of institutional quality investments: Due to the still nascent local asset manager community, investors have experienced a scarcity of sizable, high-quality investment opportunities in the region. To cater to large institutional investors, there is a need to develop alternative investment products that offer broader access and diversification, such as dedicated MEASA public equity strategies, fund-of-funds, and large-scale sustainable infrastructure opportunities.

Addressing these challenges, requires a significant and highly collaborative approach between local stakeholders – including SWFs, family offices, asset managers, and financial centres. The good news is that several countries are taking proactive measures to mitigate the risks of unsustainable economic growth. The UAE, and Abu Dhabi in particular, has launched a number of progressive initiatives including, the UAE Green Agenda, UAE Net Zero by 2050, the National Climate Change Plan, the Hydrogen Alliance, the UAE Hydrogen Leadership Roadmap, and the national carbon credit program, all of which align with the Paris Agreement and the overarching aspiration of reaching net zero by 2050. Collectively, the UAE has already invested over US$40 billion in renewable energy, reflecting the commitment to transitioning towards a net-zero economy. COP28, hosted by the UAE, will not only spotlight the nation on the global stage but also serve as a pivotal platform to showcase progress and rally participants around further sustainable initiatives.

Within this context, sustainable finance has emerged as a powerful catalyst to unlock the true potential of the MEASA region. In 2023 in Abu Dhabi alone, there has been several significant milestones in sustainable finance including, ADGM launching the Sustainable Finance Framework, the Transition Investment Lab hosting a sustainable finance event with all Abu Dhabi SWFs participating, the announcement of a US$4.5 billion financial initiative in collaboration with Africa50 to enable Africa’s clean energy transition, and the issuance of several green bonds (including FAB, ADCB, TAQA).

Building on the momentum, ADGM has a unique opportunity to solidify its position as the financial gateway for international investors to participate in sustainable finance opportunities across the MEASA region. However, to achieve this aspiration, a strong local asset management community, in close collaboration with local institutional allocators will be needed to attract international capital and facilitate the deployment across the region.

ADGM acts as a gateway for various entities to access the MEASA region, offering significant growth opportunities for partners, including international firms, banking and financial institutions, asset management firms, fintech companies, corporations, and professional service providers.

The MEASA region comprises both some of the world’s wealthiest nations as well as countries facing economic challenges. However, ADGM envisions MEASA as potentially the fastest growing region on a global scale in the coming decades. This optimism is rooted in the strength of the region’s young demographic and its growing prominence as a trade and investment hub.

Committed to sustainability, ADGM actively works to harness this potential through close collaboration with its stakeholders. Recently, the financial regulator of ADGM announced the implementation of its sustainable finance regulatory framework, reinforcing its position as a leading sustainable financial hub and a natural centre for sustainable finance activities.

The IFC will play a pivotal role in facilitating the formation, mobilisation, and allocation of both private and public capital, as well as supporting the creation and issuance of green and sustainable financial products aimed at achieving positive economic, social, and environmental objectives in the region.

At the core of ADGM’s strategic vision is a proactive commitment to drive and bolster this growth, while ensuring the success of its partner firms remains a paramount objective. Its unique position, situated at the intersection of capital supply and demand, empowers it to drive sustainable development in the MEASA region while establishing elevated standards for transparency and governance and championing progressive and robust regulatory frameworks.